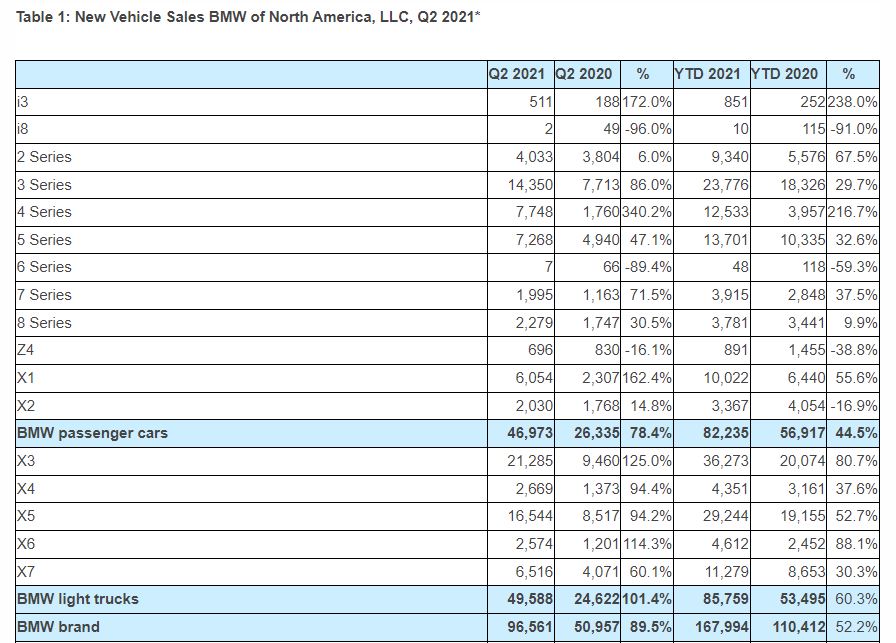

BMW sales roared upward in the U.S. market as COVID-19 restrictions were lifted in Q2. BMW sold 96,561 vehicles in the quarter, an 89.5% increase compared to the same period last year. BMW also noted in their press release that the number sold was also 15 percent higher than Q2 2019, before the pandemic. Year-to-date sales were up 52.2 percent over 2020 pandemic numbers.

Impressive numbers no doubt but context is important – the floodgates also opened for BMW’s competitors in this market. Audi sales were up 92 percent QtoQ and 62 percent YtoD. Mercedes-Benz was up 38.6 percent QtoQ and 26.3 percent YtoY – but their sales weren’t hurt as badly by the pandemic as most other car makers. In total vehicles sold YtoD they are as usual neck and neck with BMW in this market, 167,994 BMW to 160,646. Lexus sales were up 47.7 percent YtoD with 2021 sales of 157,713 vehicles.

As in other ways Tesla was an outlier, with sales increasing 50 percent last year during the pandemic. The most relevant number for Telsa is total vehicles sold YtoD in this market – 139,301. That’s more than Audi and closing in on BMW and Mercedes-Benz. (Tesla market sales numbers aren’t officially released but that number and others above from GoodCarBadCar, an excellent source of information.

Let’s look closer at some BMW 2021 Q2 sales bright spots. Many execs at the Woodcliff Lake, New Jersey HQ much be breathing sighs of relief regarding the G22 4-Series. Sales were up 216.7 percent to 12,533. Buyers apparently haven’t been dissuaded by the car’s controversial front grill, and maintaining sales volume of the 3- and 4-Series is critical for BMW’s bottom line. Sales for every line of SUV was up substantially, and BMW has sold slightly more trucks than cars YtoD, 85,759 vs. 82,235.

The rejuvenation of X1 sales has to be a welcome surprise. The current F48 generation has been around since 2016, yet sales were up 162.4 percent QtoQ and 55.6 percent YtoD. The mid-cycle refresh of the G20 5-Series might have helped increase sales, which are up 47.1 percent QtoQ and 32.6 percent YtoD. The premium SUV X7 introduced in 2019 is growing in volume, with 11,279 sold in 2021, up 30.3 percent YtoD.

Certified pre-owned (CPO) sales were up 21.1 percent QtoQ and 11.5 percent YtoD, for a total of 60,515. It’s not clear why the CPO increase was less than for new cars, though CPO sales weren’t as hard hit in 2020. It could be the additional price of a CPO vehicle, limited availability or increased competition in used sales from the likes of Carvana and Vroom. A few years ago BMW cut the CPO warranty period from six years to five which also could be having an effect on sales.

I couldn’t find any specific BMW M model sales numbers. Last year M sales bucked the pandemic tide and increased 5.9 percent globally to 144,218. Some of that increase was due to more M truck models, and some due to the M division keeping the enthusiast flame alive at BMW. In 2019 the U.S. market accounted for around 1/3 of all M sales, 44,442 last year.

Next year is the 50th anniversary of BMW M, and the company is planning some special models to celebrate. These sales numbers have become increasingly important over the years. China is by far BMW’s biggest overall market, but the U.S. is expected again to be #1 for M sales.

Clearly BMW has done a good job of recovering from the pandemic-induced sales losses of 2020. Q2 was the third strong recovery quarter in a row for BMW, counting the remarkable turnaround in Q4 2020. It may well edge out Mercedes-Benz this year and again win the luxury sales crown in the U.S. market. But the larger questions I asked in the last sales story remain.

If current sales trends hold Tesla should surpass all the legacy luxury manufacturers by 2022. The ferocious competition with Mercedes-Benz is fueled in part by the desire to be seen as the #1 aspirational brand in this market. That’s been part of BMW NA’s DNA since day one. What happens when that is no longer the case?