Silicon Valley bank bank produces an excellent annual report on the U.S. wine industry. With all the industry has been through recently, first fires and then the COVID-19 pandemic, the State of the Wine Industry 2021 report is particularly relevant.

2021 is the 20th anniversary of SVB putting out the report. It’s a deep dive into demand, supply, marketing projections and more. The most interesting section to me was a listing of challenges and opportunities facing the industry. The pandemic exacerbated existing problems but also revealed things that may assist the wine industry after the worst is over.

Opportunities

- Shelter-in-place orders created the necessity for family meals at home. Wine was added back to the family dinner table, and consumers adapted to online shopping and at-home delivery.

- Families who were able to work from home saw some expense savings that position them for an expected push in spending in a post-COVID era.

- With all competing entertainment venues closed, outdoor wine tasting found new converts through the summer of 2020. While guest counts were lower, the average ticket from winery guests was higher this past year.

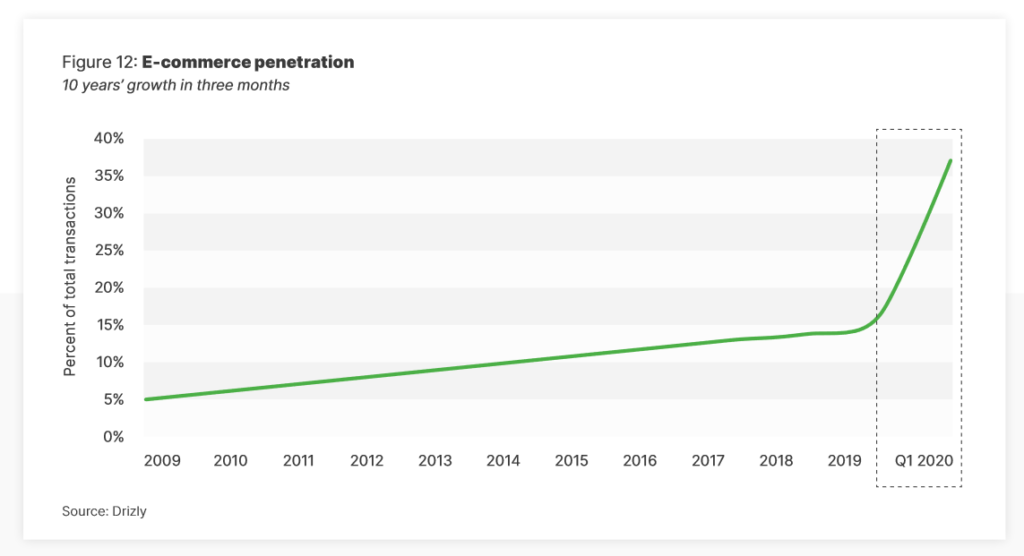

- Wine proved again that it is recession-resistant. While many stocked up on everyday wines at the supermarket, consumers also rapidly switched to online options, either because their selections weren’t available in grocery stores or because doorstep delivery was viewed as safer. Many consumers will continue online wine buying in a post-COVID world.

- Digital wine tastings took flight during the year alongside the popularity of Zoom video conferencing.

- Phone sales found new success when tasting rooms had to limit visitors or shut down entirely.

- Once there is clear success with defeating the virus, consumers will act on pent-up demand to celebrate in groups, which will likely boost alcohol consumption in 2021.

Threats

- Channel shifting to off-premise grocery received a large volume of press coverage during 2020. It was a spectacular data point, but when the US reopens, off-premise sales will unwind and consumers will find other channels to satisfy their demand.

- The challenge of recruiting younger, health-conscious, multicultural consumers into the wine category, combined with the aging of the older core wine consumer, remains. Both consumer groups have different values and spending patterns. The wine industry has done little to alter their marketing message to attract or retain either consumer cohort.

- Anti-alcohol messaging continues to grow while guidelines from a variety of government and health organizations loosely apply science to influence consumption, taxes and regulations.

- The wine industry is made up of an exceptionally fragmented producer landscape without an industry marketing organization to unify the industry’s voice, provide data or properly leverage and support current consumer marketing trends.

- While 2020 brought supply into temporary balance in most regions, there are still too many acres planted and/or insufficient growth in demand to maintain healthy grape pricing. If total volume demand remains flat or decreases, that will recommend additional removals. A large harvest is still an unwelcome event.

- The need to invest in sales channels other than the tasting room has never been more apparent, and yet there are few good examples of wineries that have succeeded with data-driven approaches and Internet sales.

- The labor supply is limited, and the price for labor is increasing.

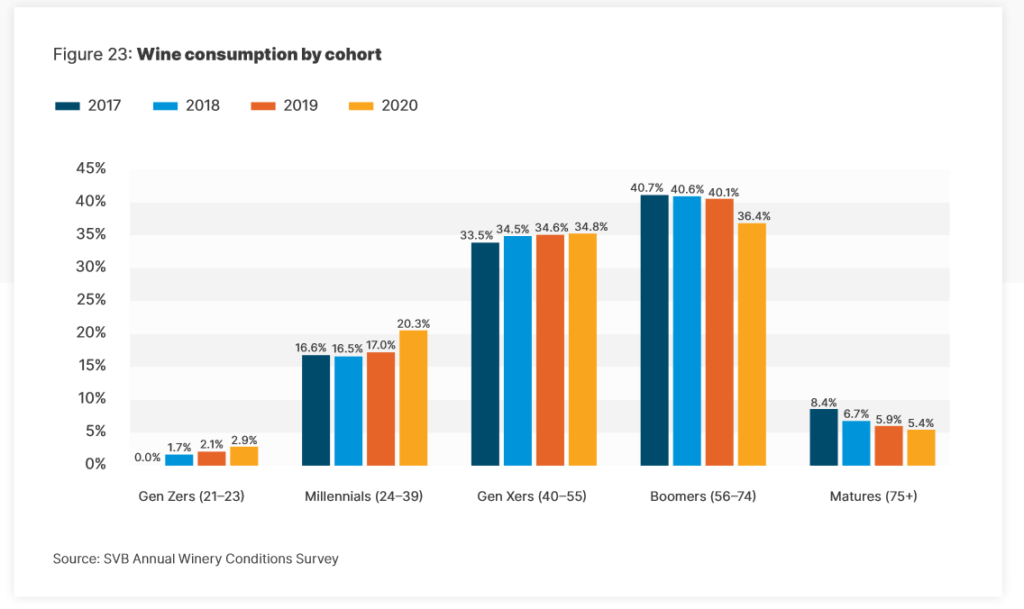

That second point about attracting younger consumers has been a big issue for years. It got a lot of attention in the 2018 State of the Wine Industry report that I wrote about here. Boomers and Gen Xers make up a big majority of wine consumers and they are not being replaced fast enough by Millennials. Latest numbers:

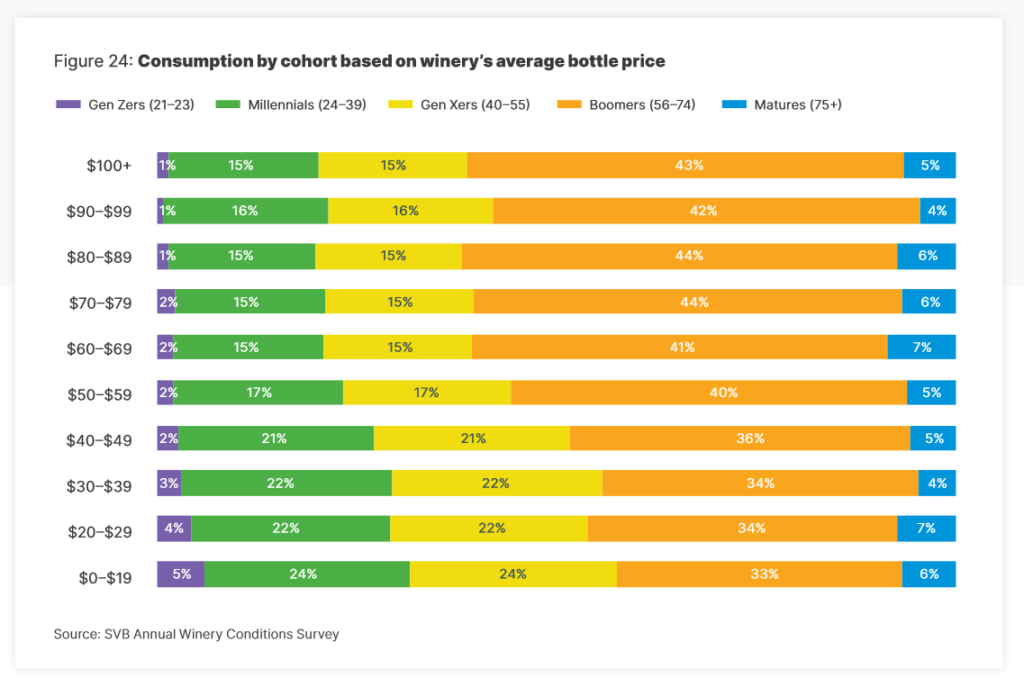

A recent article in Wine Enthusiast puts a big part of the reason for that on price. Millennials and Gen Zers have inherited reduced economic opportunities and often balk at spending big money on wine. The article explained how Sotheby’s, hardly a value-oriented brand, has introduced a label collection of classic varietal wines all selling from $17 to $40. Right in line with the Work, Wine and Wheels philosophy that $20 should be plenty to have a quality wine experience.

Here’s a graph showing wine purchases by age demographic and price:

On a more positive note, the COVID-19 crisis forced the wine industry to rely more on ecommerce. The first quarter of 2020 saw as much ecommerce growth as the previous decade, an amazing and encouraging trend for the future:

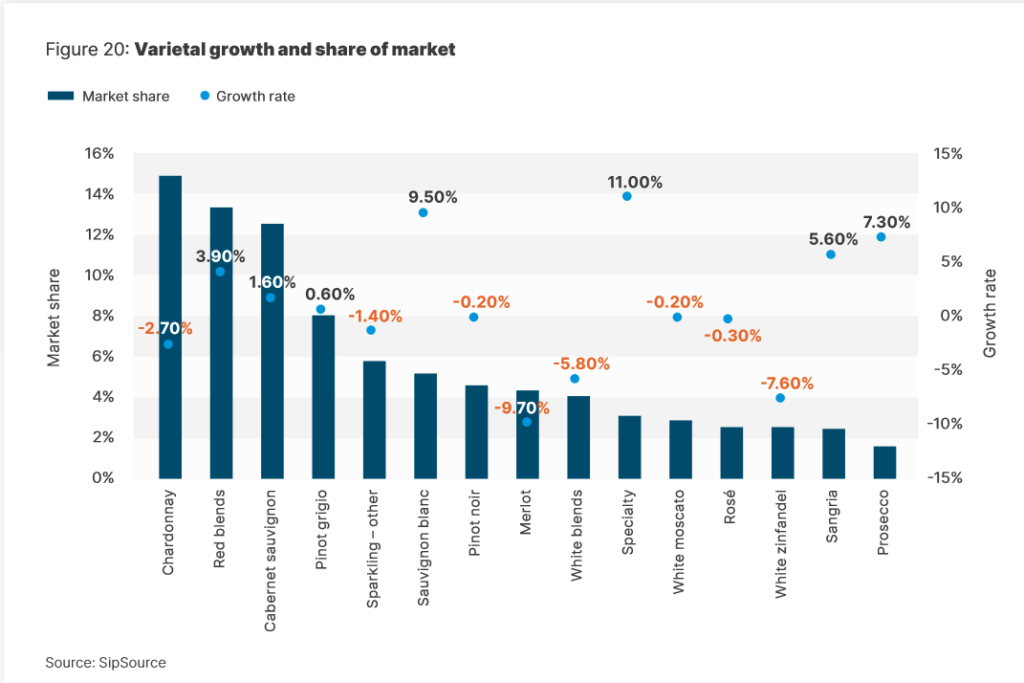

Chardonnay, Cabernet Sauvignon and red blends continue to be the most popular wines in this market:

This annual report is an excellent example of thought-leadership from SVB that undoubtedly differentiates it from other financial providers. I’m sure providing this report each year has led to building relationships and acquiring clients with the wine industry. Here’s the landing page where you can download the full report.