About this time last year I reported on a webinar that tracked the appreciation of BMW M Cars. The webinar was organized by Paul Seto, hard-working president of both the National Capitor Chapter (NCC) of the BMW CCA, as well as the director of the M Chapter. The data shared came from Hagerty senior analyst James Hewitt.

Last week they did it again, presenting the 2023 State of the Market BMW M report. This year James was joined by Sam Smith, Hagerty editor-at-large and former editor of Road and Track. It was interesting to hear the latest BMW M car values in light of the current climate of higher interest rates and economic uncertainty.

One of the first nuggets shared by Hewitt was a reality check. Private party sales make up roughly 80 percent of the classic car market. Despite all the attention online auctions like Bring a Trailer and Cars and Bids have attracted, most of the action happens person to person. Sellers want to fully control the process, and most buyers want to see the car and kick the tires.

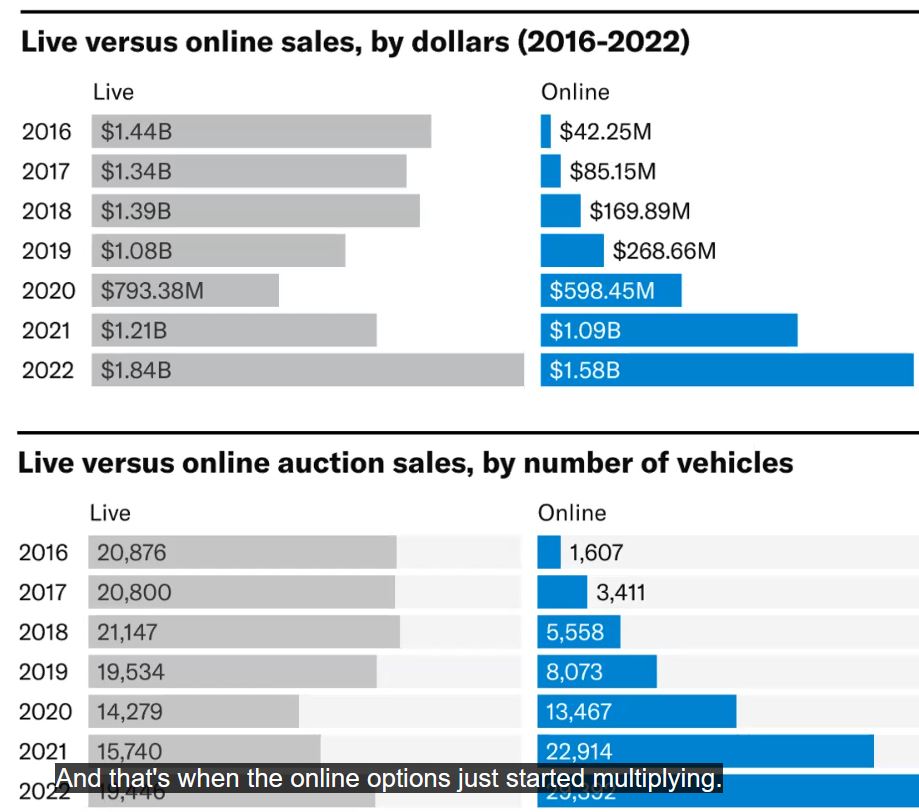

However that still leaves a lot of money in the remaining 20 percent. Going to auction used to mean a physical event organized by companies like Barrett-Jackson or Mecum. Not any more. Starting from almost zero prior to 2016, online auctions have blown past physical auctions by number of sales and are close to matching by dollar amount:

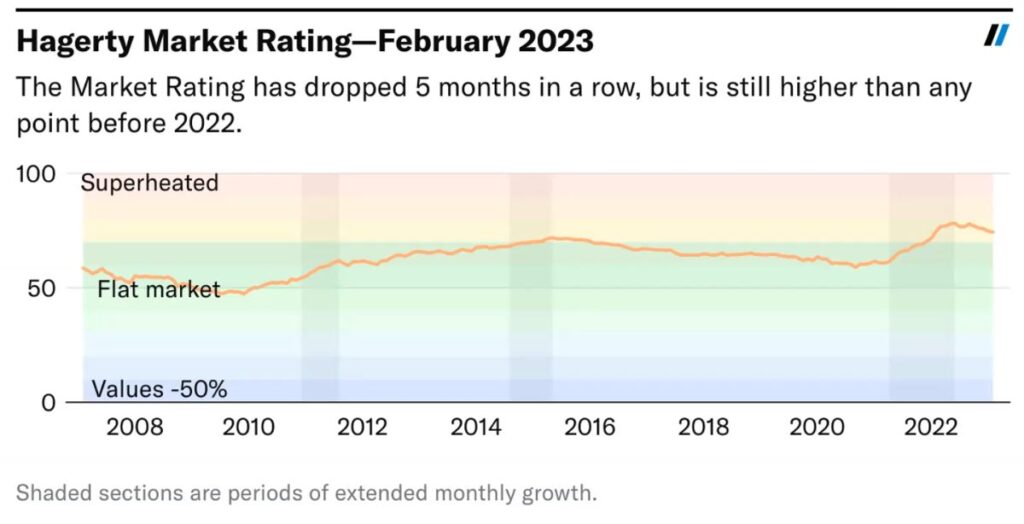

Here’s a graph shared by Hewitt on the used car market in general, not just BMW M Cars. While it has cooled off over the past five months it is still higher than any time before 2022:

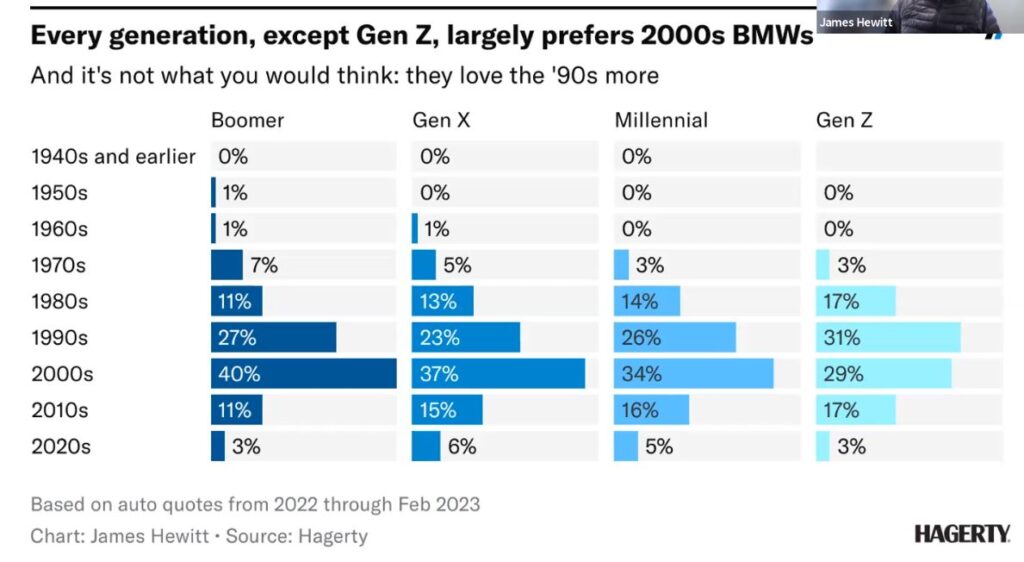

Focusing on BMW M car values, millennials quote BMW values the highest, i.e. when they insure their cars with Hagerty. These younger buyers especially like the E90 (2008-2013) and F80 (2014-2019) generation M3 cars. Generation Z is the only demographic to prefer cars built before 2000, albeit by a small margin:

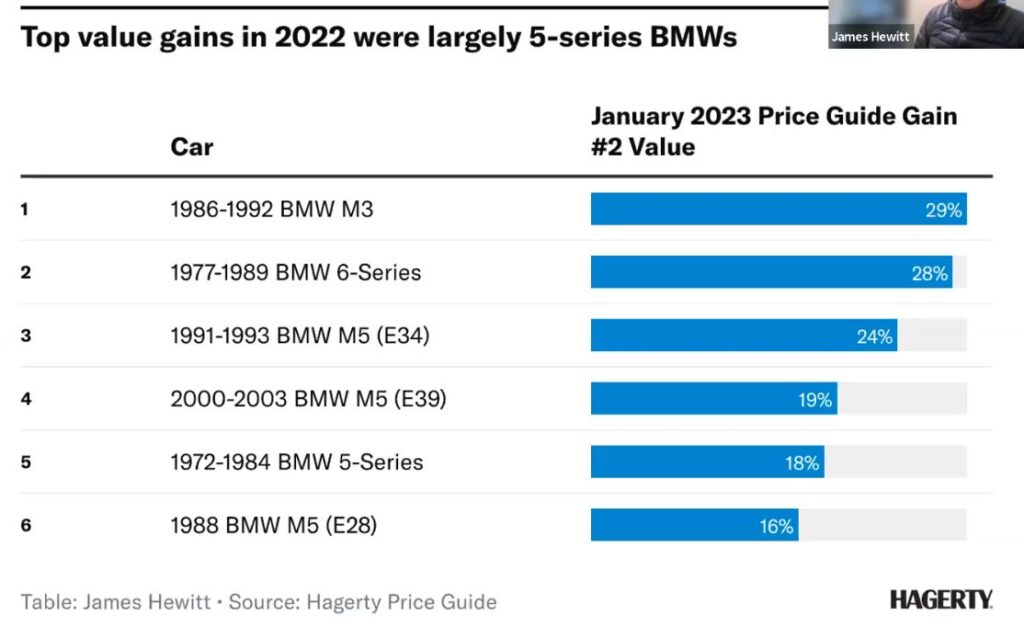

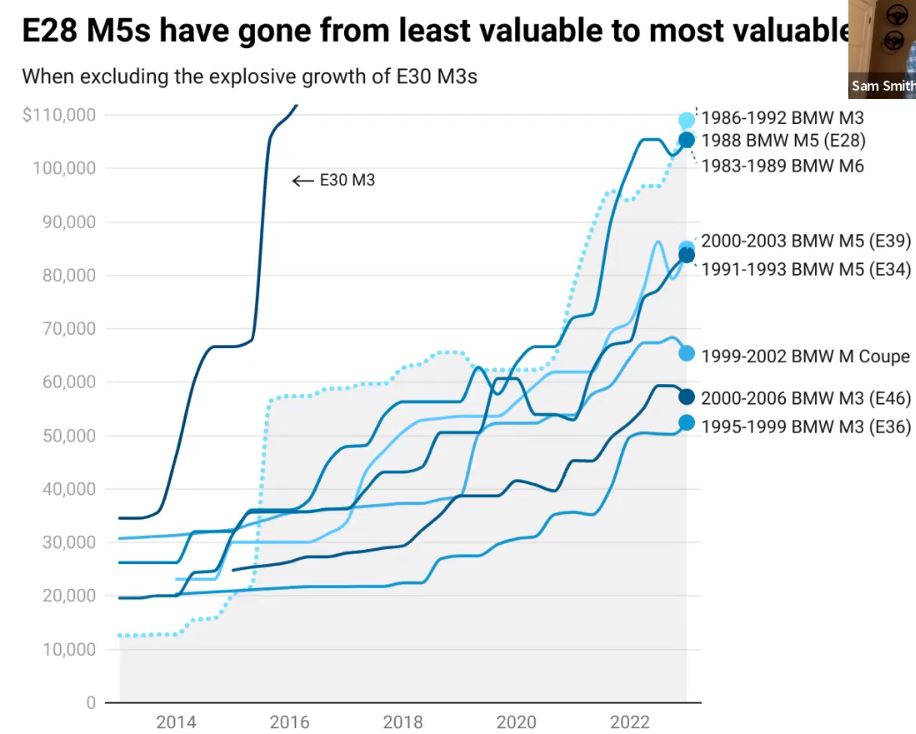

BMW M car values have often plateaued for a period of time and then appreciated rapidly. Hewitt pointed out the example of the E28 M5, which in 2014 was worth the least on average of any mass production M car. Today the Hagerty data shows that the car is now worth more than any M car other than the E30 M3. Note these values are based on the car being in Hagerty condition 2, meaning it could win a local show competition.

Some other notable BMW M nuggets:

- Z3 M Coupes continue to be worth roughly double the Roadster versions, and both are up 24 percent in past two years.

- The Z8 continues to zoom up, 25 percent in the past three years.

- Modifications do not necessarily hurt value if done well with respected parts and labor, and the car does not become too individualized. Hewitt shared example of an E46 M3, Laguna Seca Blue, 13K miles, SMG transmission sold for $34,250 on BaT in 2019 and then for $79,500 on BaT in October 2022 after a 6-speed conversion by Enthusiast Auto Group.

- There are massive differences in value based on the car’s condition, 1-4 in Hagerty speak.

- The BaT premium has fallen. Last year it was 24 percent, the premium a seller could expect selling on BaT, but unfortunately, Hewitt didn’t have an exact updated number.

It definitely adds something to the ownership experience knowing that my two old M cars are becoming more valuable every year. I also appreciate being able to get agreed-to-value policies from Hagerty, so that if anything happened their true value would be paid out to me.

The link to the webinar is here. Contact me for the passcode if you’d like to watch it for yourself.

UPDATE 11/20 – Doug DeMuro of Cars & Bids says it’s official, the car market is going through a correction: